There has been much recent debate over the use of plastic bags by supermarkets. Consumers are being encouraged to reuse their plastic bags with Marks & Spencer even charging their customers 5p or 10p for their plastic bags.

Symphony Environmental Technologies produce an additive which, when added in the manufacturing process, creates biodegradable plastic. This applies not just to shopping bags but to all short-life plastic products. Symphony could benefit considerably from today’s environmental concerns. Symphony disagrees strongly with the course taken by M&S. In an RNS statement in March 2008 Symphony's CEO, Michael Laurier said. 'The bags they are selling are made partly from recycled material and partly from virgin material, but they are not degradable and will still lie around in the environment for hundreds of years. As an environmentally-responsible company, M&S would be well advised to put our additive into their bags, as the Co-op has already done. The 5p they are charging would pay for the additive many times over.'

The plastics issue is being debated around the globe and several countries, most notably Brazil, Argentina, Slovenia and Romania have introduced legislation to encourage shopping bags to be made from degradable material.

Symphony Environmental Technologies, previously named Symphony Plastics was formed in 1995 and listed on AIM in 2001. I met with Commercial Director, Michael Stephen, and Finance Director, Ian Bristow, at Symphony’s office in Borehamwood. Ian was one of the co-founders of the company in 1995, whereas Michael’s involvement as a Director is more recent - he first joined the board as a non executive director in 2007 before taking on the Commercial Director and Group Deputy Chairman role in October 2008.

Michael explained that Symphony has undergone considerable change in the last 18 months. In particular, the Group has moved away from selling completed products and now concentrates on selling its d2w additive to factories, through a worldwide network of distributors.

|

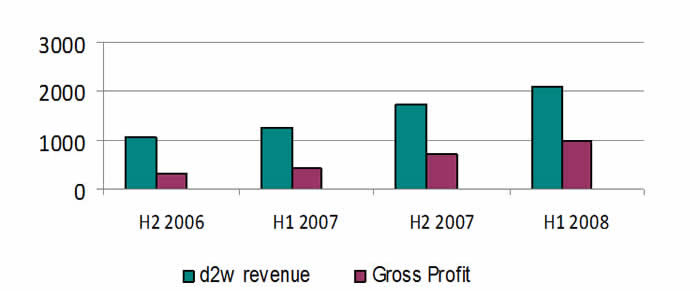

Certainly a look at the chart above confirms an improving position. However, over the years Symphony has shown promise on a number of occasions and investors will need to be assured that things really are different this time before committing to investing in the company. After introducing the Group’s technologies and products we will consider Symphony’s future prospects.

Hydro and Oxo

Plastic is produced from a by-product of refining oil. It is a strong, light and extremely useful product but has the disadvantage of being almost indestructible. Untreated plastic will last for hundreds of years. There are two major technologies that seek to deal with this problem.

Hydro-biodegradable Plastic

This is a starch based plastic made from corn crops which has had some popularity, particularly in the USA and in Germany. However, such ‘plastic’ has the distinct disadvantage that it uses much needed resources, including agricultural land and water, to produce. Furthermore hydro-biodegradable plastic emits methane when it degrades in the absence of oxygen - methane is more than 20 times more potent for global warming than carbon dioxide.

Oxo-biodegradable Plastic

The Symphony product falls into this category. This is a much cheaper alternative whereby an additive is added into the plastic during the manufacturing process. Oxo-biodegradable plastic will degrade over time to leave just water, carbon dioxide and some harmless trace elements. The degradation process will ‘shut down’ if the plastic is enclosed without oxygen as in a landfill site. Unlike the ‘hydro’ product the ‘shelf life’ of the product can be varied. Plastic produced in this way has numerous advantages, including being lighter and stronger. It can be made to be transparent which is not possible with hydro bio-degradable plastic, and it can be made with the same machinery as ordinary plastic.

Symphony’s Oxo-biodegradable plastic additive is traded under the “d2w” registered Trademark. The following two paragraphs from Symphony’s www.degradable.net website explain the process further:

The degradation process is initiated at the time the polyethylene or polypropylene is extruded by the inclusion of a small amount of a special additive. This additive works to break down the carbon-carbon bonds in the plastic leading to a lowering of the molecular weight and eventually to a loss of strength and other properties. Stabilisers work to ensure that a sufficiently long useful life is provided for each specific application. For example, a refuse sack might require a useful life of say 18 months before beginning to lose its strength whereas a bread bag might only require a few weeks.

Significantly, the d2w™ range does not need a biologically active environment to start degrading - this will happen even if the plastic is left in the open air! This is very important if we are to address the serious litter problems caused by waste plastic. For this reason in particular, d2w™ 'totally degradable' plastic is superior to 'bio-degradable' which requires the plastic to be in a biologically active environment (for example, by being buried in the ground) before the degradation process is initiated.

As the plastic degrades it initially turns into small flakes which are no longer a plastic, before eventually biodegrading into water, carbon dioxide and small amounts of trace elements. (Examples of the small plastic-like flakes can be found in this journalist’s loft where I have been able to prove that plastic sacks made using Symphony’s d2w™ are most unsuitable for long term storage!)

Applications & Customers

The degradable plastic has numerous uses.

This slide from a recent Symphony presentation illustratessome of these.

...whilst this second slide shows some

of the big name companies that

use the product.

The Distribution Model

Symphony have changed their business model radically over the last 18 months. In the company’s early years they concentrated on manufacturing and sale of finished plastic products with a focus on the UK market. However, today the group mostly sells the d2w additive to plastic manufacturers. Furthermore, there has been a marked shift to selling through international distributors. Symphony had 7 international distributors in June 2007 but this has increased rapidly to a count of 43 today, covering more than 50 countries. These resellers are small or medium sized businesses which deal with the local plastic production companies and end-users. The resellers are spread throughout the world with particular strength in Latin America.

Michael Stephen explained that many of the distributors are not primarily plastics companies but they are all well connected organisations with good track records.

There have been some notable successes for this model in 2008 with three major new contracts being announced during the year. These were located in South Africa, The United Arab Emirates and Mexico. The Mexican contract was to supply Grupo Bimbo, one of the largest bakeries in the world. In Mexico and many other Latin American countries Bimbo is the largest food company, and they have just announced that they are buying Westons in Canada. The Bimbo contract was announced in August 2008 and will make a positive contribution to the second half of the Group’s 2008 financial year.

Michael indicated that there are still areas of the globe where they would like to improve their distributor coverage. The most notable area is North America. In the USA hydro-biodegradable products have attracted attention but Michael reported that Symphony have had recent approaches direct from US companies wishing to use the d2w product.

In addition to its focus on degradable plastics, Symphony, through its Symphony Energy subsidiary, is also developing innovative waste-to-energy technology and cost-effective processes to convert plastics, tyres and other waste streams into valuable products. The main focus here at present is on a research project considering processes for the recovery of materials from waste tyres. The project named ‘Rupert’ (RUbber Product Enhanced Recovery Technology) is being supported by a £1.2 million grant from the UK Technology Strategy Board.

Symphony is leading a consortium in this ‘Rupert’ project as reported in the following paragraph from Symphony’s RNS dated 27 May 2008:

‘The Company is the lead partner; the other members of the consortium are Imperial College London, ABB Limited (Robotics Division), Hughes Pumps Limited, Credowan Limited (Subsidiary of Cobham Plc) and ARTIS (a business of Avon Rubber Plc). The partners were chosen for their expertise which wholly supports the collaborative research and development of microwave pyrolysis and rubber product enhanced recovery.’

There is a worldwide problem in dealing with mountains of used tyres. The ‘Rupert’ project is developing a process which uses high pressure water to reclaim rubber and steel from old tyres. Symphony believes that this new process is cleaner, quieter and cheaper than existing tyre recycling processes. The new process will be demonstrated in London early in 2009.

I asked the Symphony directors about the timescale to full commercialisation of this technology. They were optimistic that there could be major developments here during 2009 and it would not be too long before machines were being produced for customers. However, it is still early days and additional funds would eventually be required to support commercialisation. One possible option that could be considered is to raise such funds in a new company floatation.

The Shares

Symphony’s largest shareholder is Australian investment group Hunter Hall who own 18.7% of the Group’s shares. Symphony’s CEO Michael Laurier owns 9.7%.

We believe that Symphony’s shares are more actively traded than those of many similar-sized small companies. To illustrate this point, on the day of writing this article it would have been possible to buy hundreds of thousands of the shares – these were available at a small discount to the quoted offer price

Symphony’s shares have performed badly since floatation on AIM, falling by over 90% in the 7 years on AIM as can be seen from this first chart.

However, during 2008 the share has stabilised and has out-performed the AIM index by a considerable margin as can be seen from this second chart. This improved share price performance reflects the changes at Symphony over the last 18 months.

Symphony’s broker, Hoodless Brennan have produced forecasts up to and including 2010 – although these 2010 forecasts must be somewhat speculative at this stage.

|

Turnover £m |

Pre-tax Profit (loss)

|

Earnings (loss) per share - pence |

Year to 31/12/07 |

3.78 |

(1.91) |

(2.3) |

Six months to 30/6/08 |

2.30 |

(0.17) |

(0.16) |

Year to 31/12/08 (forecast*) |

4.90 |

(0.40) |

(0.37) |

Year to 31/12/09 (forecast*) |

7.5 |

0.50 |

0.52 |

Year to 31/12/10 (forecast*) |

9.6 |

1.40 |

1.31 |

* Hoodless Brennan forecast at November 2008.

Symphony had debt of approximately £1 million at 30th June 2008. Of this figure, £380,000 is a Headstart convertible loan due to mature on 31st March 2009. The company have stated that they are seeking to repay or refinance this loan at a more favourable rate.

The Hoodless Brennan forecast shows the company moving to a much needed positive cash flow during 2009. In the meantime the balance sheet is weak and any unforeseen cash flow difficulties could be problematical. On a positive front, with 85% of its sales overseas, the business will be benefitting from weak sterling – the pound has weakened further since the broker forecasts were made.

Symphony is operating in a high growth area with massive potential. Of course there are risks that better technologies or differing perceptions will affect the potential adversely.

The company has proved a very poor investment to date but its change in 2007 to a distributor based model has had a major positive impact. In fact, with the rate of growth of these distributors and some of the recent contract wins, prospects are looking bright.

The weak balance sheet is a negative, particularly in today’s marketplace. It may be that the improvement in business will see Symphony to positive cash flow very soon but unforeseen difficulties can arise and if extra funds were needed quickly the terms may be unfavourable.Having said that, Symphony has had generous support from its substantial shareholder Hunter Hall on two occasions in the past.

Symphony’s tyre recycling project seems to have exciting potential and could be a big money earner one day. As yet there is little information about the prospects here but it is worth looking out for news of developments with ‘Rupert’.

Symphony’s final results for the year to 31st December 2008 are likely to be released in March 2009. We will be looking to see if these confirm the considerable improvement shown in the first half of the year. We will review these results and any changes to the broker forecasts at that time. As they stand today, the broker forecasts indicate a highly promising future for the company. If these forecasts are met then we would expect to see a considerable re-rating of the shares.

The shares today seem cheap for a company with such promise. The weak balance sheet and the Group’s history along with general market conditions account for the low price. At this level the shares may appeal to speculative investors who believe that Symphony are likely to fulfil their promise.

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2008

RETURN TO AIMZINE NEWSLETTER HOME | January 2009

|

||