Plethora Solutions

Valuable Assets and a New Business

RETURN TO AIMZINE FRONT PAGE | January 2010

| Code: PLE | Price: 12p | Number of Staff: 10 |

| Sector: Pharmaceuticals | Market Cap: £5.0 million | Location: London |

A Urology company may not be the first choice for private investors seeking exciting growth opportunities. However, urology specialist, Plethora Solutions, does appear to have considerable embedded value as well as having potential for future growth. Plethora was one of the four companies which we featured in last month’s ‘Small and Here to Stay’ article. In this article we take a much closer look at the Company.

I met with Chief Executive, Steven Powell, and Non Executive Director, Ronald Openshaw (Ronald is also acting as Interim Chief Financial Officer) at Plethora’s London Office.

Urology can be sexy

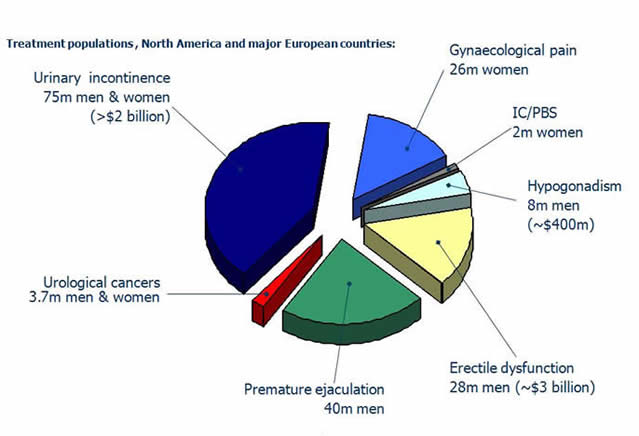

Steven Powell explained that Urology is far from the first choice for people seeking a career in medicine. For example, Cardiology and Respiratory Medicine are much more popular with medical students. However, Urology does offer significant growth prospects for a company such as Plethora. As the slide below shows (from a recent Company presentation) the treatment population in the Western world is approaching 200 million and with an ageing population this figure will continue to grow.

Plethora at a glance |

+ Embedded Value from future royalties |

+ Potential of new Urology Company |

+ Debt considerably reduced |

+ R & D spending trending to zero |

- Wide bid/offer spread |

- Timescales for royalty payments uncertain |

- New Urology Company only in early stages |

- Recent placing at 30% discount to current price |

Plethora’s focus is on developing and marketing drugs to address the conditions outlined in the diagram above. Indeed they have products which address many of the larger slices in the pie chart.

The Company listed on AIM in March 2005. Until recently the Company had concentrated on the development of a number of urology drugs. Consequently Plethora generated little revenue in its early years on AIM. Turnover in 2007 was just £10,000 which rose to £640,000 in 2008. However 2009 has seen some big changes.

In May 2009 we featured another AIM-listed Urology company in Mediwatch – click here to read this article. Mediwatch develops and supplies medical devices as opposed to Plethora which focuses on drug treatments.

PSD502

2009 has seen some

big changes

Transformation

Plethora has undergone some major restructuring over the last year which has completely transformed the opportunity from an investor’s standpoint. The key changes have been:

- Sale of the global rights for PSD502 (treatment for premature ejaculation) to Sciele Pharma Inc, a subsidiary of Shionogi Corporation, the large Japanese pharmaceutical company.

- Evaluation and option agreement for PSD503 (treatment for urinary incontinence) with an ‘international pharmaceutical company’.

- Reduction of Group debt by over 90% with remaining debt rescheduled to 2012.

- Placing (November 2009) to raise £1.5 million.

- Roll out of a new subsidiary. The recently announced Urology Company will market and distribute a portfolio of therapeutic products to UK urology clinics.

The involvement of ‘big pharma’ and the reduction in debt serve to reduce the risk for Plethora and yet they have still retained some exciting potential going forward.

The new ‘Urology Company’ will provide another separate revenue stream which will utilise Plethora’s experience and contacts in the UK Urology market. At the same time there will be a considerable reduction in Research and Development spending. R&D spend in 2008 was £9.2 million but the forecast is that R&D will trend to zero in 2010.

Assets

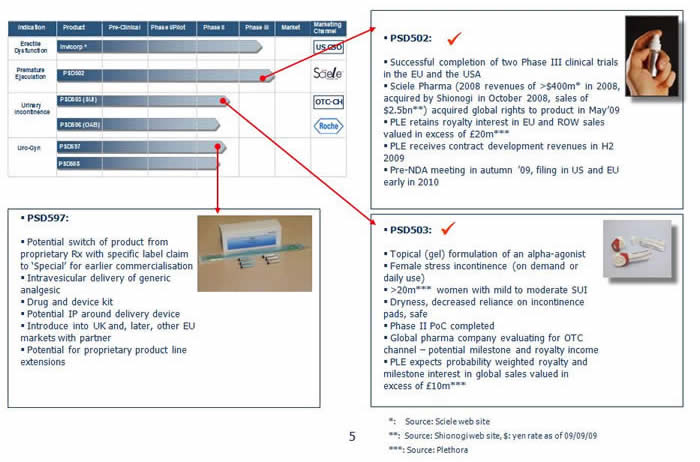

Plethora has a number of drugs at an advanced stage of development. The slide below shows the status of the Company’s six most important products with a further expansion on three with particularly high value.

retained some exciting

potential going

forward.

Strong Track Record in Clinical Development: Embedded Value

To date Plethora has received $29.1 million from Sciele for the development of PSD502 and the worldwide rights to the product. However, the Company has retained the rights to a low single digit percentage royalty on all sales of PSD502 outside of the USA and Japan. House broker, FinnCap, estimates the value of this royalty stream to Plethora at £21 million. It is anticipated that the royalty revenue from PSD502 will start to flow in the second half of 2010 although this timescale is subject to European regulatory approval as well as Sciele’s speed in bringing the product to market with a European marketing partner.

The value of the PSD502 royalty stream is much higher than Plethora’s market capitalisation of approximately £7 million. However, this is not the only product in the portfolio that is expected to provide substantial returns. PSD503, a stress incontinence formulation, has been estimated to have a risk adjusted net present value in excess of £10 million. We await further news (expected mid 2010) on PSD503 following the announcement in July 2009 of the product evaluation by a Global Pharmaceutical Company.

royalty revenue....

will start in the second

half of 2010

The Urology Company (TUC)

This recently formed new subsidiary is expected to generate revenues from mid 2010. The first stage of the Company’s plan is to create a portfolio of 7 to 9 products and it is anticipated that this first tier of products will have all been launched by the end of 2010. The products will be a mixture of branded generic products and proprietary products.

Steven Powell explained that Plethora will be marketing products for a wide range of conditions. They are particularly seeking to purchase the rights to niche products with a small but established revenue where there is potential for organic growth.

UK Marketing agreements for the first two products in the TUC portfolio were announced at the end of the November. Please click on these links to read the announcements for the Testosterone Replacement therapy and the Dianatal Obstetric Gel. Dianatal has been proven to significantly reduce the duration and trauma of labour for women giving birth for the first time. Steven admits that Dianatal is not strictly a Urology product but he believes that it has considerable potential and the Company will be able to market the product through the same channels.

TUC will sell its products primarily to Urology Clinics with the majority of sales expected to be to the National Health Service.

The new subsidiary is seen as a low cost start-up which will draw upon Plethora’s existing specialists. The Company are targeting breakeven for the Urology Company by the end of Year 2.

Dianatal.....

has considerable potential

The Shares

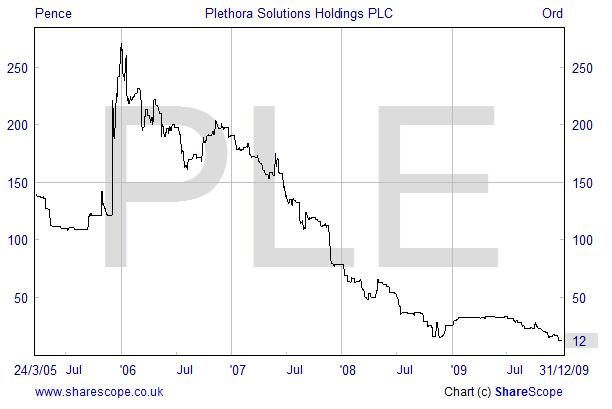

The Company’s original plan was to develop and market its own products. This plan was thwarted by the financial crisis due to lack of available capital and a requirement to pay down debt. At the beginning of 2006 the PLE shares were trading at £2.60 but now are below 20 pence.

Trading in the shares is usually light. At the time of writing there is a 5 pence bid/offer spread. However, when we tried an online quote to buy 25,000 shares, we were offered these at the mid price.

The Company recently completed a placing of 11.15 million shares at 10 pence per share to raise £1.5 million. The new shares represent 26.6% of the enlarged share capital. Encouragingly, directors subscribed for 12.5% (£195,000) of the total raised in the placing.

At the time of writing Merlin Biosciences are listed on Plethora’s website as the Company’s largest shareholder with 29.2% of the shares. However, this is likely to change as the substantial shareholder figures have yet to be updated following the recent placing.

'We tried an online quote for 25,000 shares and were offered these at the mid price'

The Numbers

The table below tells the story of the huge changes that Plethora has been undergoing. The forecast figures are taken from FinnCap’s most recent (November 2009) note.

Year ending 31/12 |

2007 |

2008 |

2009 (Forecast) |

2010 (Forecast) |

2011 (Forecast) |

Revenue (£m) |

0.01 |

0.64 |

18.00 |

1.00 |

2.10 |

Profit (£m) |

(11.57) |

(14.07) |

9.50 |

(0.44) |

0.05 |

Earnings per Share (pence) |

(34.60) |

(42.26) |

29.9 |

(1.1) |

0.1 |

With the recent restructuring the Company has reduced its debt level from £30.8 million to £1.75 million. Additionally the Company has subsequently raised £1.5 million in the November 2009 placing. The Directors believe that they now have sufficient funds to take Plethora to profitability.

Aimzine Comment

This sector has had a torrid time due to the lack of available capital. Many AIM-listed pharmaceutical companies have had severe financial difficulties and several have been forced to de-list from the AIM market. In such circumstance Plethora has done well to survive. The effect of the restructuring gives the Company a credible plan going forward.

This small AIM Company has some very valuable assets. The two main products are at an advanced stage which is positive from a risk standpoint. However, it will be some months and possibly over a year before any revenues are seen from these products.

The placing of £1.5 million and re-scheduling of debt announced on 18 November is welcomed because it will provide funds to roll out the new Urology Company subsidiary as well as funding PSD502 and PSD503 through to revenue generation. The placing at 10 pence per share was at a 35% discount to the then mid price of the shares. In today’s markets we have seen many shares trend towards the placing price after a heavily discounted placing and there must be a risk of this in Plethora’s case.

That said, the long term value of Plethora’s product pipeline is estimated at many times the existing market capitalisation and barring major problems it would seem likely that this value will be recognised in the share price at some point in the future.

Potential investors in Plethora may be tempted to wait until nearer the time that royalty payments are expected before investing. However, with such embedded value in the company, there is a risk that such a strategy would miss out on substantial share price appreciation.

value will be recognised

in the share price at

some point

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2010

RETURN TO AIMZINE FRONT PAGE | January 2010

|

||