Image Scan Holdings

As you struggle through an airport baggage check, have you ever glanced at the screen of the x-ray machine showing the bags being scanned? If you do, you will be surprised that the operators are able to spot the ‘suspicious packages’ from the indistinct images that they see. These systems detect the majority, but not all potential weapons, resulting in quite a number making their way to ‘airside’. Our subject company, Image Scan Holdings, market a baggage scanning system which utilises 2 camera arrays to provide a much clearer, 3D, x-ray image whereby the probability of detecting a threat item is significantly improved.

Image Scan was formed in 1996 to exploit the 3D imaging expertise developed at Nottingham Trent University. Much has been achieved since that date with the Company now having an impressing range of x-ray products. However, the Company has yet to show a profit.

The Company has recently undergone a strategic review which has resulted in a restructuring of the board. In December 2008 the Company’s founder, Nick Fox, moved from Chief Executive to Chief Technical Officer and Louise George moved from Finance Director to Chief Executive. I spoke to Louise early in February

.

Louise is enthusiastic about her new role and she is keen to bring a commercial focus to the business. She explained that her role to date has been very much focussed on the Finance and Operations of the business, but in her new position she is ‘empowered to take a lead in the business’.

Share Price

Louise joined Image Scan in 2002 – the Company had just floated on AIM at the time. At that time there were high hopes that a sales and marketing agreement with Rapiscan, a ‘dominant global manufacturer of security screening systems’, would bring much revenue for the Company. However, plans for Rapiscan to deploy Image Scan’s technology world-wide never came to fruition, resulting in few sales.

|

The disappointment with Rapiscan along with the company’s failure generally to fulfil its early promise, has caused the share price to decline from over 70 pence in 2002 to 2.5 pence today. At this level the Company has a market capitalisation of just £1.4 million. With over £1 million in cash the market is attributing very little value to the business.

Whilst there have been disappointments, turnover has gradually crept up over the last few years topping £2 million in 2008 whilst losses are now reducing. This progress with the business is not yet reflected in the share price.

The recently completed strategic review considered options for selling the company but concluded by saying: ‘It is felt that with the prevailing market conditions affecting the availability of funds for investment, attempts to seek a purchaser for the Company at this time would be unlikely to fully reflect the Company's potential’.

Image Scan is a small company employing just 12 people in addition to the Board members. The company outsources the majority of its manufacturing with its expertise being in the design and development of 3D x-ray technology to present the best image quality.

Image Scan conducts its business through a wholly owned subsidiary, 3DX-RAY Limited. 3DX-RAY’s products are used in both Security and Industrial applications.

In the security field, the Company markets baggage scanning equipment. The large Axis-3d® machines can be used for bulk baggage scanning whereas the FlatScan-TPXi is a lightweight and portable system – the photograph here shows this system being operated by the British Transport Police at a London’s Waterloo station.

Image Scan’s large Axis-3d® machine is similar to the systems seen at airports. However, the price tag associated with Image Scan’s systems means that it is unlikely to be sold in large numbers to airports. Louise explained that with two camera frames and high quality components they are unable to compete on price with the cheaper conventional machines, which meet regulatory requirements and hence appeal to the airports’ buyers. However, Image Scan regards its Axis-3d® machine as a worthy and more cost effective alternative to the multi-view systems which are sold in smaller quantities into the aviation sector.

Louise noted that the recent success in selling into China and India demonstrates how the Axis-3d® is suited to niche markets with heightened security needs, which can justify the cost of providing the increased probability of threat detection.

As well as curtailing the activities of would-be terrorists and smugglers, Image Scan’s products play an important role in some industrial applications where they are used to detect concealed components, voids, faults and contaminants within a variety of products. For more information on the Company’s products see the 3DX-RAY website.

Over the last 2 years more than half of Image Scan’s sales have come from the Industrial sector. More recently sales into this sector, particularly the automotive applications, have been affected by the economic downturn so it is likely that 2009 will see the security sector sales dominating.

At the beginning of February Image Scan announced its first sales into India where its Axis-3d® and FlatScan-TPXi machines will be used at Delhi’s principal railway station. This order comes shortly after the Mumbai terrorist attacks in November 2008 and it is clear that such terrorist activities do strengthen the demand for Image Scan’s products.

However, Image Scan’s largest customer by order value, Johnson Matthey, is in the Industrial sector. Over the last 5 years this international chemicals company has purchased several of the MDXi systems for the inspection of its catalytic converters. These systems are in use in the UK, the USA, South Africa and will shortly be installed in Japan. With so many systems in use, Image Scan receives good regular revenue from Johnson Matthey for spares and support.

The Company’s industrial equipment is in use in several other industries. For example they have recently completed a £1 million contract for British Nuclear Group providing them with innovative in-line inspection equipment. Also, in 2008, the Company sold a system to Boston Power Inc for the inspection of laptop batteries at their plant in Taiwan. The company is expecting further sales in this latter sector in 2009.

A substantial part of the current order book is represented by the £630,000 order for baggage screening into China from Shanghai Unitech. This order follows successful deployment of an Axis-3d® system at the Beijing Olympics.

An increasingly important contributor to Image Scan’s revenue comes from its Belgium based international reseller, Industrial Control Machines (iCM). iCM increased its sales of the FlatScan-TPXi systems from 15 in 2007 to 44 in 2008.

The Numbers

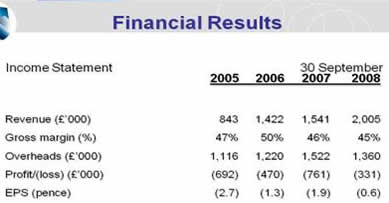

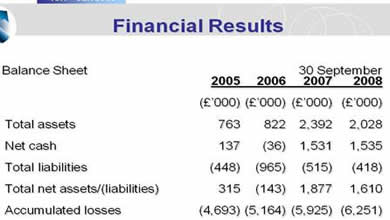

These two slides from a recent company presentation show that turnover has increased substantially over the last four years. Also, after some disappointment in 2007, losses are gradually reducing. Should these positive trends continue the company’s cash pile should be sufficient to see it through to profitability.

There is no analyst coverage for Image Scan but the market has been informed of progress so far this year. After a disappointing first quarter, the Company has recently reported having an order book of £940,000. A good flow of orders will be required in the second half of the year to maintain the revenue growth. However, recent cost reductions should help to reduce losses. The savings this year will only be for nine months of the year and will be offset by £30,000 in redundancy payments and the cost of the strategic review. Hence it will be the 2010 financial year before the full benefits of the savings are seen.

Image Scan has over £6 million of accumulated losses. Thus, when the company does eventually achieve profitability it will be some while before its profits are taxed.

the Company has recently

reported having an

order book of £940,000

Investment Considerations

Image Scan is a fascinating prospect. Whilst the shares have disappointed over the years and long term shareholders have suffered badly, the Company is now at a key point in its development. The change of CEO and new commercial focus may well have a big positive impact on the company – but it is by no means guaranteed.

More than 70% of the Company’s shares are in public hands with the directors, primarily Nick Fox, owning 6.4%.

Over the years, despite the falling share price, Image Scan has made considerable progress developing an impressive product range and gaining some prestigious clients. Turnover has increased and losses are reducing. The latest round of cost cutting will further help to nudge the Company towards profitability.

Despite a very quiet first quarter, prospects going forward are reasonable. However, with little recurring revenue, the Company is dependent on winning significant orders. Otherwise, further losses would soon eat into the £1 million plus cash pile and there may be little opportunity to raise further capital should trading deteriorate.

Judging by the significant contracts that the Company has secured to date, Image Scan’s products have tremendous potential. This potential could come from some of the following areas:

- Further penetration of existing customers

- Expanding existing applications to new customers e.g. nuclear, batteries, catalytic converters

- New industrial applications

- New security customers

- New geographies

Image Scan’s reach is global and the Company will need to concentrate their limited sales resources in the areas which will bring immediate wins.

We believe that the hope of great potential for this company is still alive despite 6+ years of disappointments on the AIM market. Image Scan with a new CEO and a stronger commercial focus is at a significant stage in its development. We wish Louise George and all at Image Scan well over the coming very important year.

Aimzine will be commenting on all important Image Scan news items over the coming months.

Judging by the significant

contracts that the Company

has secured to date,

Image Scan’s products

have tremendous potential.

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2009

RETURN TO AIMZINE NEWSLETTER HOME | March 2009

|

||