The Lean towards Green

Helius Energy

Following his introduction last month, Alex Race takes a look at the first company in his series on Renewable Energy Companies. Helius Energy is an interesting company which even has plans to generate power from the waste product of a whisky distillery. With a cash pile greater than its market capitalization Helius is worthy of further investigation

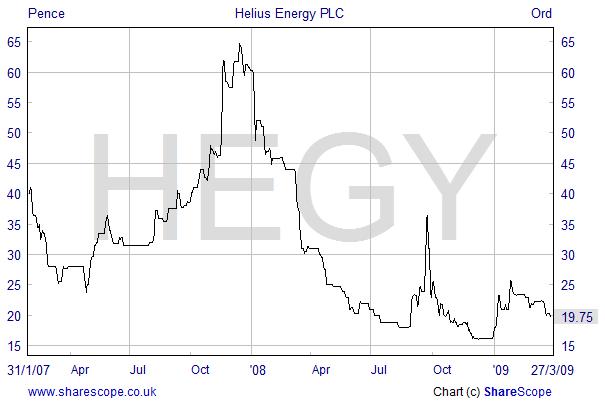

Market Capitalisation: £17 million

Share Price: 19.75 pence

|

Helius MD, John Seed |

generate power from

the waste product of a whisky distillery

Backgound

Admitted to AIM in 2007, Helius Energy (HEGY.L) is a developer of both large (over 60Megawatts) and small modular (5 – 8Megawatts) biomass-powered electricity generation plants.

The group was established to develop, and ultimately own and operate, a portfolio of biomass power plants located at carefully selected sites where sustainable feedstock and the associated infrastructure is readily available.

Biomass fuel is derived from plant-based, animal and vegetable material and can include many ordinary things such as dead trees and branches, garden clippings and wood chippings.

With the successful sale of their first project (Stallingborough, Lincolnshire) to European utility giant RWE last year, cash-rich Helius now has a pipeline of new projects upon which to build the Company’s fortunes. With an experienced management team, some exciting projects and proven performance in a growing market, Helius has performed solidly in these turbulent times.

Biomass fuel

Projects and Pipeline

Helius has a dual strategy of developing large (over 60MWe) biomass-fired power stations and designing and installing smaller (5-8 MWe) biomass-fuelled heat and power plants, based on its modular GreenSwitch technology.

Helius sold its first 65Mwe Stallingborough project to RWE for a total of £28.1 million plus a 13% carried interest in the future profits of the plant for 24 years (valued at £14.3 million). Additionally, Helius has also signed a Technical Services Agreement with RWE to provide ongoing support to ensure the plant is delivered as per the proposed project timetable. This agreement is valid for 4½ years during which time Helius will be remunerated at commercial rates.

Helius has also signed an option to lease an 18 acre site located within Avonmouth Dock, on the Bristol Channel, for the proposed construction of a 100MW biomass power plant. On 9 February 2009, Helius confirmed that it had submitted an application for consent to the Department of Energy and Climate Change (DECC) for this project and has entered into a statutory consultation process with relevant authorities and statutory bodies.

According to its 2008 Annual Report, ‘It is anticipated that the Group will secure a further site for another 100MWe biomass plant during the first half of 2009, with a S36 planning application being made before the end of 2009. Finally, the Group is also considering opportunities outside the UK where the political and economic climate supports the development of biomass power generation. Such opportunities will be stringently reviewed and only progressed in conjunction with capable feedstock, technology and financing partners to mitigate risk.’

The Company’s first commercial project utilisising its modular GreenSwitch technology has been signed with the ‘Combination of Rothes Distillers’ in Scotland.

Helius’ GreenSwitch 5-8 MWe plants are designed to be located where sustainable and renewable feedstocks are readily available, such as breweries and distilleries, avoiding the costs of transporting wet feedstocks.

GreenSwitch plants have been designed to generate onsite electricity and export any surplus to the local electricity network, providing potential customers with an environmentally sustainable and economic method of utilising processing by-products.

The Combination of Rothes Distillers (CoRD) project has just been granted planning permission and the group expects to secure further projects of this size over the next two years . This extract from the January 2009 RNS illustrates the green credentials of this project:

‘The project........will see the installation of a GreenSwitch™ biomass-fuelled combined heat and power (CHP) plant to the rear of the CoRD's existing site to the north of Rothes. The CHP unit will use a combination of distillery co-products and wood chip from sustainable sources to generate 7.2 megawatts of electricity, enough for 9,000 homes, which can be used onsite or exported to the National Grid.

As part of the project, a new GreenFields™ plant will be built alongside the GreenSwitch™ CHP unit and will turn the liquid co-product of whisky production, known as Pot Ale, into a concentrated organic fertiliser for use by local farmers.

Cash Rich

Unlike many small companies at the moment, Helius is cash rich. Indeed, on 28 January 2009, the company announced that it had bought back just over 1 million shares, which will reduce the Company’s issued share capital by 1.2%. At its year end on 30 September 2008 Helius reported net cash of £24 million.

In its 2008 full year results, Helius showed a profit of £30.7 million - £33.6 million was generated by the sale of its Stallingborough project to RWE.

Conclusion

With its debt eliminated, ‘Helius now has sufficient funding to undertake the multiple developments planned for the next 3 years’ – Alex Worrell, Chairman’s statement at 26 January 2009. Having exceeded the milestones set at its admission to AIM in 2007, the management has proven their worth. If the companies past performance is any indication of its future prosperity, then Helius Energy could be the AIM renewables success story everyone else has to beat.

Alex's wind energy blog can be found at http://www.depthchargewind.blogspot.com/

If you would like to comment on this article please click here or visit our SocialGo site

Rothes Distillery

The project has just

been granted

planning permission

Written by Alex Race

Copyright Aimzine Ltd

RETURN TO AIMZINE NEWSLETTER HOME | April 2009

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |