Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

Each month we speak to a number of AIM Companies. Frequently we hear directors claim that their share price is far too low. Indeed, some directors have put forward strong arguments as to why their own company share price particularly undervalues the company.

The AIM market is very different from the Main market in that private investors have a strong direct influence on AIM. We asked Dru Edmonstone, Head of Corporate Broking at Rivington Street Corporate Finance, for his views on the subject. Dru commented: ‘Today AIM is little more than venture capital with a quote. The market is being driven by private investors, who company directors ignore at their peril. If a director believes that his company shares are undervalued then I would suggest he takes the lead and buy some of the shares himself, thus sending the right message to the private investor community who are likely to follow suit.’

Six Companies

This month we have asked six companies to explain why they consider their share price, or the AIM market, is undervalued. All six companies make some very interesting comments, not only about their own share price but also about the AIM market in general.

The six companies we feature are:

- Cyan Holding

- Advanced Power Components

- CBG Group

- Nexus Management

- Carpathian Asset Management

- Hexagon Human Capital

Click on the links above to navigate directly to a company’s section.

'If a director believes that

his company shares

are undervalued then

I suggest that he takes

the lead and buys some

of the shares himself'

By Kenn Lamb, Chief Executive Officer

I’m a fan of Fabless semiconductor business model. After the development of the first chip has been funded surprisingly little incremental investment is required to scale up to very large revenues. All manufacturing is outsourced, the more you buy the cheaper it gets, the more you build the better you get at reducing costs, sustaining margins while prices reduce. Sales, marketing and customer support is mainly outsourced to independent distributors (80:20 rule) providing global coverage quickly and for minimal investment. Distributors take on the responsibility for shipping, invoicing and chasing payments thus helping cashflow.

However, publicly listed fabless semiconductor companies can easily be undervalued. If they come to market before the funding-intensive R&D stage is complete it is understandable that investors’ patience can wear thin while waiting for product commercialisation and product orders to take off. Cyan is guilty of this error and has suffered the consequences.

Cyan Now

Cyan now has very competitive products developed for wireless applications. Our Microcontroller (MCU) products use one device where competitors require two. Cyan has now developed products for all forms of automated metering, smart meters, demand control systems as well as Street Lighting controllers that substantially reduce energy consumption. Through global distribution Cyan addresses these fast growing markets that are benefiting from significant investment by governments, generated by the combined requirement for economic stimulus and climate change.

Cyan’s intensive investment phase is behind us, the Fabless business model means that we can now scale rapidly, a clear requirement as we gain traction in these markets.

I now have to question whether Cyan’s valuation recognises this potential or the investment and time required to get the Company to this stage.

Advanced Power Components (APC)

By Mark Robinson, Chief Executive

Faced with difficult market conditions, it is essential to adapt and survive: companies need to be more flexible, think long term and ensure that they provide optimum service. Only by doing this will they be in the best position to take advantage once the market begins to recover.

At APC we are proactively generating new suppliers, customers and business models in anticipation of the market’s eventual recovery. The share price of smaller AIM companies simply cannot recognise this level of proactivity until financial progress is made; hence valuations are all in the basement regardless of the work and progress going on behind the scenes.

Our existing distribution business model is all about adding value through technical expertise, and this is being recognised by a number of significant component manufacturers, including the world’s largest capacitor manufacturer, AVX, which recently signed a distribution agreement with us. Similar new agreements with other manufacturers are also in progress. The net effect will be the creation of significantly more potential to be realized as the market recovers.

In addition, we are getting back into ‘manufacturing’. The announcement of a technology licensing agreement made in January 2009 will generate a new revenue stream from an environmentally friendly technology which is about to be promoted worldwide, excluding North and South America. Initial trials and feedback have been very positive.

At APC, we are building on a business platform that has been operationally profitable over the last 12 months and we are working hard to position ourselves successfully to reap the benefits once market conditions improve. We have maintained or even improved market share in our core distribution business, and our entry into the growing sector of environmentally friendly technology could prove very lucrative. Based on this, we believe our current valuation looks extremely attractive.

By Mike Askew, Group Managing Director

As a profitable, dividend paying well run business with cash in the bank we already set ourselves apart from the majority of companies on AIM. We operate a high margin, growth orientated company continually outperforming our peers.

As an insurance business our operations are straightforward. Basically, what you see is what you get. We focus on providing insurance broking, employee benefits and wealth management advice to companies and private clients, bedding in all acquisitions into two core operating divisions.

The spread of business provides a useful hedge, which means that better performing divisions offset others depending on which part of the cycle we are in. Effectively this underpins stability and revenue generation with the breadth of our offering providing resilience, even in the current market.

Current economic conditions are some of the toughest ever seen. That said our business model and lean operations have helped to insulate us while ensuring we are well placed to take advantage of the upturn.

Our share price performance has been disappointing. At current levels our underlying business is trading on less than six times earnings – a lowly multiple compared to our peers. With insurance rates expected to harden further and consolidation in the sector likely to grow, we see ourselves as well placed to benefit from these opportunities.

For the past six years, since joining AIM, whilst we have grown through acquisition we have demonstrated excellent organic growth and we very much look forward to continuing this development.

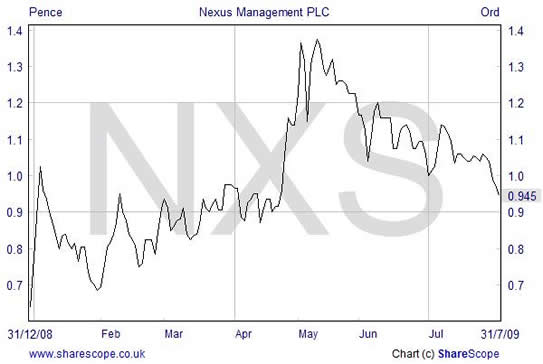

The undervaluation of AIM shares is a serious issue and there are many complex interrelated reasons for this which are difficult to address in a few words, but Nexus understands this better than most.

Over the past 3 years Nexus has increased turnover; become profitable; increased earnings per share; increased the quality of earnings - by diversifying revenue base, attracting a wider and more established customer base; and entered new markets. Nexus’ share price, however, is virtually unchanged on where it was 3 years ago. While a company could be bitter about this, Nexus realises that the Company, market makers and investors all play their parts.

A company is responsible for making sure that its story is understood.

Nexus has an exciting, but complicated, story – we don’t just “do” IT but can address customers’ technology needs from numerous different angles through our four subsidiaries - Nexus UK, Nexus US, Nerd Force and Resilience Technology Corporation.

Smaller companies, such as Nexus, often find getting their message across time-consuming and expensive; and have to carefully balance the cost of this task against the ultimate goal of delivering higher profits. Without awareness there are no investors; but without profits there are no investors either.

Market makers are responsible for ensuring that their traders have an understanding of the companies they represent and sufficient credit/trading lines to take a reasonable position in the shares.

In November Nexus’ share price fell by over 80% during the collapse of broker Echelon, which had a position of some GBP 60,000 worth of Nexus shares. Nexus remains one of the most liquid stocks on the AIM market and it is a sad indictment of the market that such a small position should cause such a wild swing and discourage investors from entering the market.

Institutional investors need to be present in the market.

Primarily as a result of the reasons above, institutions are continuously raising their threshold as to the size of company in which they will invest (typically those with a market cap of GBP 20m). Institutions continue to remain relatively absent in the AIM market; when they do invest in AIM companies it is typically only in profitable ones, and they use PE multiples applicable to much larger entities - failing to acknowledge that for the profitable smaller company the cost of being public (audits, advisors, PR, non-execs etc) has a disproportionate effect on the net profit generated.

This is a self fulfilling prophesy – if you don’t invest in companies, or only invest in those with higher PE multiples, they will remain low and undervalued!

In three years: |

|

|

|

|

By Paul M Rogers, Joint MD, Carpathian Asset Management

Carpathian, the Central and Eastern Europe (CEE) retail property investor, has had its problems, being spawned from an investment group that went into administration a year ago.

The AIM property sector has been particularly affected by the global credit crunch. Fears of over-rented, over-priced, over-geared assets, banks clawing back debt, plus concerns over CEE economies have hit share prices hard.

Look through these headlines, however, and one may see opportunity: asset values have dropped from previous valuations – but not so much against purchase costs; the CEE property market never became as debt burdened as the UK; and despite recent movements, local currency rates are similar to when tenants took their Euro-based leases five years ago.

Barring significant problems experienced within Hungary, performance overall is mixed with positive signs across Carpathian’s wider portfolio. We have recently:

- experienced far less tenant default than the UK;

- seen increasing retail sales and rents in Poland;

- sold a Czech shopping centre at a 7.1% yield (£11.2m pre-tax profit);

- purchased a strategic property adjoining our most prime Warsaw asset, unlocking extension potential;

- re-financed €275m of assets till December 2011, removing all LTV covenants;

- gained institutional shareholder support to continue operations and maximise value;

- announced the intention to distribute 8 pence per share by 01/05/2010.

Cash will be utilised only to support strong equity retentive assets, while cost reductions will help drive positive cash flow. Individual ring fenced mortgages prevent any problems arising from cross contaminating the portfolio.

The management team predates Carpathian having experience over 30 years, fronting highly profitable private ventures for institutional and high net worth investors throughout previous market cycles.

As long-term property operators, we see the current cycle and the over reactive quoted markets as an opportunity to be carefully exploited by investors.

By Jonathan Wright, CEO

For many of us, AIM is in the teeth of the perfect storm – lack of liquidity – small cap nervousness – debt. The result is a significant number of undervalued stocks.

A key problem in attracting investor interest is the wide choice of options investors have when looking for recovery stocks. Our first challenge must be to convince the market that we have robust business models. Furthermore, I suspect that many of us will now have significant operational gearing that will enable us to benefit from improving market conditions in the future. I can see an increasing number of public to public purchases taking place to leverage this gearing, which will in turn improve liquidity. The key obstacle will be debt.

The past 6 to 12 months really have given company boards the opportunity to eradicate unnecessary cost. This will build in the operational gearing that I mentioned earlier and should drive margins as the market recovers. I feel we all need to provide economic guidance and be very focused on not just the macro issues but also give real and substantiated guidance to investors on the micro factors affecting our particular sectors. It is unreasonable to expect a business services analyst, for example, to have the in depth knowledge that can identify detailed factors in specific sub sectors.

I also believe in a strategy that takes advantage of the available talent in the market. Up skilling will be key to developing competitive advantage and will be another differentiator when looking to attract investor interest. Depressed share prices also provide an opportunity to bring key staff into the equity of the business and with people dependency being a fundamental driver in most sectors this must also enhance investor interest.

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE NEWSLETTER HOME | August 2009

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |