Crimson Tide

RETURN TO AIMZINE FRONT PAGE | September 2009

Code: TIDE |

Sector: Technology |

| Price: 1.5 pence | Market Cap: £4.8 million |

| Locations: Tunbridge Wells & Dublin | Number of Staff: 18 (including directors) |

Having just completed its third year on AIM, Crimson Tide is making good progress in difficult times. There are a number of strong positive indications that this Group has considerable potential.

I spoke to Executive Chairman, Barrie Whipp, who founded the business in 1996. Barrie is happy with the progress of the business during its three years as a listed company. In this time the Group has increased turnover and reduced losses to near break-even point. He is particularly pleased that the business was able to report its first EBITDA profit in the interim results for the first half of 2009.

The Business

Crimson Tide is a provider of mobile data and software solutions. These solutions enable employees to use smartphones to complete tasks remotely and interface with central systems.

The Group’s customers pay for the solutions by monthly subscription, with the initial contract typically being for three years. In most cases Crimson Tide provides its customers with smartphones when the contract is first set up. Whilst this does mean that there is an upfront cost when new contracts are set up, these multi-year contracts do provide considerable stability for the business.

To give readers a better idea of Crimson Tide’s solutions we have included three examples of their applications in the coloured boxes on the right-hand side of this article this article.

|

Barrie Whipp

The Shares

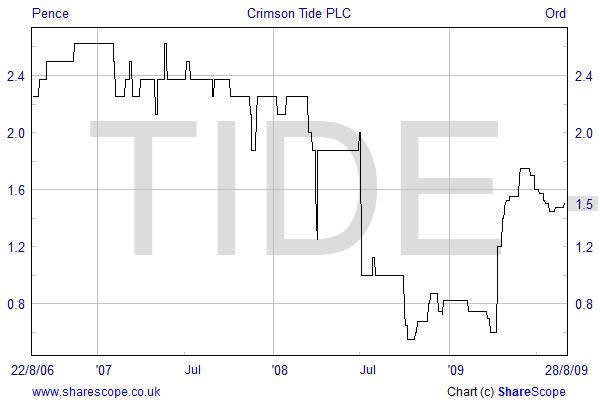

Crimson Tide joined AIM in August 2006 in a reverse takeover of non-cash shell company, A Cohen. At that time Crimson Tide raised £500,000 (net) in a placing at 1.5 pence per share. Given the exceptionally weak AIM markets of 2007 and 2008 it is a credit to the Group that its shares have almost held their value over the last 3 years.

Crimson Tide at a glance |

+ Growing cautiously avoiding shareholder dilution |

+ Increasing deal size |

+ New middleware product will improve margins |

+ Healthcare solutions with exciting growth potential |

- Irish economy tough |

- Reduced Turnover but higher margsin 2009 |

- Lack of funds could restrain growth |

- Shares not at bargain basement price |

Crimson Tide was named after the University of Alabama Athletics Football team (Barrie Whipp is an American Football fan and once played at Free Safety in the formative years of the British American football League). Alabama, who play in crimson and white, were first given the nickname Crimson Tide by a journalist following a famous victory in 1906. The name Crimson Tide was also used for a 1995 film starring Denzel Washington and Gene Hackman. This fictional drama follows a US nuclear submarine given the order to make a pre-emptive strike on Russia. The name of the submarine was USS Alabama which is presumably connected to the Crimson Tide title. |

One reason that the shares have held up well is that they are tightly held by those close to the business. Unusually, for a listed company, the top 4 shareholders are directors of the company – Barrie Whipp holds 36.2% of the issued capital. The fifth largest shareholder with 6.1% of the shares is the Group’s broker, W H Ireland.

Crimson Tide have completed 2 small equity fund raising exercises since coming to AIM. They raised £220,000 at 2 pence per share in 2007 and £300,000 at 1.21875 pence in 2008. The Group would have benefitted from more funds in the last year. In his Chairman’s statement in the recent Interim results, Barrie Whipp commented that the lack of availability of debt has limited how quickly the Group has been able to grow its subscription based business. However, Barrie explained to me that the board do not want to get involved in any major issue of equity which would dilute the interest of existing shareholders. Instead they have preferred to grow ‘cautiously’.

The Numbers

In their three years as a listed company, the Group has steadily increased turnover and reduced losses. Indeed, in the Interim results issued on 11 August, Crimson Tide reported that it had achieved its first profit on an EDITDA basis in the first half of this year. In these Interim results to 30 June 2009 only a small pre-tax loss of £35,000 was reported; down from £159,000 in the same period in 2008.

The reduction in losses was achieved despite revenue falling from £902,000 to £753,000. The fall was due to poor performance by the Group’s Irish subsidiary, which has been affected by the particular problems affecting the Irish economy. In the Interim results the chairman noted: ‘Management reacted very quickly to the situation in Ireland and put in place measures to minimise our exposure to the downturn and therefore keep losses to a minimum. The UK has outperformed sufficiently to more than cover these losses.’

Barrie expects that the remainder of 2009 to remain ‘flat’ but that 2010 will see a return to growth in turnover and profits. The house broker’s forecasts (see below) show the company achieving a profit of £0.7 million and earnings per share of 0.16 pence in 2011. At that level Crimson Tide would be trading on a forward p/e of just under 10.

A leading supermarket chain reports facilities management issues in its stores to our customer. Our customer schedules an engineer to visit the store and the visit details are “pushed” to a smartphone. We have already saved the engineer a visit to the office. When he arrives at the store, the engineer uses the camera on the smartphone to record the state of the issue when he arrives. He then completes the job, records his findings and takes a second photograph to prove that the situation is rectified. All of the information is transmitted wirelessly back to a website hosted by Crimson Tide where our customer can ensure that jobs are done correctly and engineers’ time is maximised. The live website is displayed on a 42” plasma screen in the client’s office. |

|

Year to 31/12/08 |

Year to 31/12/09 (Forecast) |

Year to 31/12/10 (Forecast) |

Year to 31/12/11 (Forecast) |

Turnover (£m) |

1.78 |

1.52 |

2.00 |

2.85 |

Pre-tax Profit (£m) |

(0.28) |

(0.03) |

0.20 |

0.70 |

Earnings per share - pence |

(0.09) |

(0.01) |

0.05 |

0.16 |

Favourable Developments

Whilst there is always a risk that any given forecast will not be achieved, we can report that there are a number of important factors which should lead to improvements in results for Crimson Tide. We have listed five items below that, taken together, must give the Group a very good chance of meeting or even beating expectations.

-

New Middleware: The Group has recently completed the development of its own middleware product. This product, developed with the assistance of Microsoft, will remove the need to buy in expensive middleware for each of its client projects. It is estimated that this will save 30% of the direct costs of the subscription business.

-

Larger Projects: To date Crimson Tide’s largest solution has been for an 80 user application. However, the Group are finding that they are now quoting for much larger deals than hitherto and are hoping to be able to report on some large contract wins in the coming months.

-

Yes Telecom: In May this year the Group reported a new partnership with Vodafone subsidiary, Yes Telecom. This tie-up will enable Crimson Tide solutions to be sold through Yes Telecom’s business partner base of 500+ mobile communications dealers throughout the country. In the Group’s recent Interim results it was noted that 2 partners with substantial sales teams had been recruited.

-

Reducing Development Costs: As the number of completed customer projects has increased so the development time for new and similar solutions is reduced. The recent Interim results included this encouraging comment; ‘Our healthcare applications have matured so that they can now be classified as proprietary products in their own right, as well as being part of our service based offerings. We feel optimistic of future opportunities for these products.’ In light of the success of ‘the nurses premature baby application’ (See coloured panel to the right)it is likely there will be a strong demand for similar applications.

-

Smartphone Supplier Contract: A promising new contract was reported in the Interim results: ‘We have recently been awarded a contract with a major supplier of smartphones where we are their exclusive sales channel for business to business telemarketing campaigns during 2009. The leads from this campaign are significant and range from handset supply to mobile network connections and to full mobile data solutions. The leads are with larger organisations and include local councils and the NHS. We would expect some of these leads to materialise in 2009, with more to come in 2010.’

One of the world’s leading suppliers of financial information uses a Crimson Tide system to “audit” the state of its offices in Central London. The auditor records a range of information on the smartphone which is transmitted to our website in real time. As in many of our cleaning and facilities management systems, the results are graded against a standard. A large proportion of our customers refer to the grading system and measure it against Service Level Agreements. Information from our system is automatically emailed to supervisory level staff to ensure that the performance ratings are being maintained. |

| One of our mobile applications enables nurses’ homecare time to be optimized. Our scheduling application ensures that nurses are used most effectively and a good example is in the treatment and monitoring of premature babies. A nurse is notified of a job on her handheld device and receives the relevant details of the baby whose home he/she needs to visit. The smartphone then leads the nurse through a system that was previously paper based to ensure that the baby’s vital signs are recorded and a specific drug can be administered. The smartphone application is truly “smart” in that it will warn the nurse if blood pressure or temperature, for example, is out of range or out of the ordinary. The nurse can then administer drugs and the dose is recorded on the smartphone. Follow up visits and notes for the consultant can also be created on the smartphone. |

Aimzine Comment

Until 2002 my career was in IT projects and solutions. I have long believed that there is massive potential in mobile computing and this is particularly so today with fast improving hardware and telephony. In my view, Crimson Tide are extremely well positioned to benefit from a long lasting period of rapid growth in this sector – although, there will be many other, much larger, companies competing for this business.

Crimson Tide is trading reasonably well despite difficult economic conditions, which have been particularly severe for their Irish operations. Whilst growth has been restrained by a lack of debt funding we were pleased to hear Barrie’s comments that the Directors have not wished to dilute shareholders interests by substantial equity fund-raising.

The shares trade on a 2011 p/e of just below 10 which is not cheap by current AIM standards. This will be partly due to the Group having some loyal substantial shareholders. However, the long term nature of the Group’s contracts should perhaps warrant a higher than average rating.

All forecasts are miss-able, but I have a sneaking feeling that Crimson Tide will perform very well against the broker’s estimates. They have the recent YES contract, improved margins and potentially much larger contracts all working in their favour. Couple this with a potential general economic recovery and the business could do extremely well.

A key factor will be the winning of some larger contracts and we will be looking out for some of these to report upon in our monthly Featured Companies Update column.

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2009

RETURN TO AIMZINE FRONT PAGE | September 2009

Discuss this article

|

||