Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

Each month we trawl through hundreds of RNS statements from AIM companies. In this column we will highlight an exceptional item from an AIM company, particularly where we feel the market may not have accounted for recent news.

This article is copyright of Aimzine Ltd. No part should be copied, reproduced or distributed in any way without prior consent.

Before we take a look at this month’s Snippet, it is worth reviewing the performance of some of the recent Snippet companies. Amongst the companies on the Snippet list – see the archive list at the foot of this page – there are some excellent performers. These are the top risers:-

|

Up 204% in 11 months Up 97% in 10 months Up 32% in 5 months Up 33% in 4 months Up 80% in 3 months Up 37% in 2 months |

As we have said (many times) we do NOT tip shares and do not recommend that you buy the shares we cover in the Snippet column. We are simply highlighting some interesting and encouraging newsflow which we think is worthy of further thorough investigation.

Something Green

A year ago we published an article on Helius Energy in our ‘Lean towards Green’ series. Helius develops and operates Biomass power plants. Biomass fuel (see photograph) is derived from plant-based, animal and vegetable material and can include many ordinary things such as dead trees and branches, garden clippings and wood chippings.

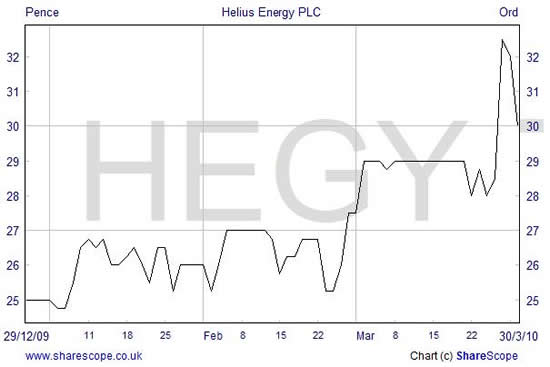

We have selected Helius for this month’s Snippet column following the release of an RNS on 26 March: Helius announced that it had been granted permission under Section 36 of The Electricity Act 1989, by the Department for Energy and Climate Change, for the construction of a 100MW biomass-fuelled electricity generating station located at Avonmouth Dock, on the Bristol Channel. The Company’s shares reacted favourably to this news, although they have fallen back subsequently.

In announcing the consent, the Company stated that: ‘Helius is currently considering a number of options to progress the scheme, including the participation of industrial and financial partners. Consent under Section 36 of The Electricity Act 1989 allows Helius Energy plc to progress the project at Avonmouth and more details of the scheme will be announced in due course.’

|

shares reacted favourably

Last Time

Helius Energy also gained a similar permission for another large site on the Humber Estuary in June 2008. On this occasion the project was sold to RWE Innology in September 2008 for £28.14 million. In addition Helius will receive 13% of the profits from the Humber plant for the first 24 years of operation.

We have no information as to whether Helius will sell or develop (with partners) the Avonmouth project. However, given that the Avonmouth project, at 100 MW, is larger than the Humber one, at 65 MW, it is likely that there is potential to unlock considerable value from Avonmouth.

Results

In the most recent results (to 30 September 2009) Helius Energy reported that it had ‘Made progress in negotiating sites for future large projects’. The Company recorded a pre-tax loss of £3.97 million and had net cash of £14.73 million.

This article is copyright of Aimzine Ltd. No part should be copied, reproduced or distributed in any way without prior consent.

Aimzine Comment

Helius Energy has a market capitalisation of approximately £25 million. It has a number of valuable assets, the most important of which is the Avonmouth project. It would seem very likely that this project alone is worth more than the market capitalisation of the Company. In the event that the Company were to follow the same path as it did with the Humber Estuary project, then the value in the Avonmouth project could be realised quite soon.

This article is copyright of Aimzine Ltd. No part should be copied, reproduced or distributed in any way without prior consent.

There is a lot more to Helius Energy than we can cover in this column. As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research.

potential to unlock

considerable value

| Recent Aim Snippets | |||||||||||||||||||||||

|

|||||||||||||||||||||||

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE FRONT PAGE | April 2010

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |