Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. Register here to read this month's Aimzine |

Before we consider this month’s ‘Snippet’ company I thought it would be worth a brief look back at the 12 companies (see the archive list at foot of this article) we covered in this column during 2010. It is pleasing to report that three of the 12 shares have performed exceptionally well:

- Sagentia Up 272% in 12 months

- Nature Group Up 191% in 11 months

- Motive Television Up 155% in 6 months

The remaining 9 shares have yet to make much headway and in the case of Cinpart (now renamed as Active Energy) the shares have fallen away by 50% since we wrote about them in May. Although, even this one poor performer has recently reversed its downtrend.

Improving Statistics

This month the ‘news’ that I would like to consider can be found within the London Stock Exchange’s monthly statistics. I have reproduced below a small part of the LSE’s AIM Market Statistics below (The full document can be found here).

Funds raised on AIM in 2010 (£million) |

|||

2010 |

New issues |

Further issues |

Total |

January |

19.0 |

205.4 |

224.4 |

February |

19.4 |

336.2 |

355.6 |

March |

204.0 |

239.4 |

443.4 |

April |

80.5 |

411.4 |

491.9 |

May |

5.2 |

426.9 |

432.0 |

June |

59.0 |

566.0 |

625.0 |

July |

86.7 |

491.0 |

577.7 |

August |

75.1 |

220.1 |

295.2 |

September |

128.7 |

281.9 |

410.6 |

October |

188.4 |

449.0 |

637.4 |

November |

217.4 |

885.0 |

1102.4 |

The table clearly shows a fast improving position as more funds become available for AIM companies. This is great news for AIM and particularly good news for AIM stockbrokers who will be receiving some substantial fees.

Small cap specialists

There are a number of small cap specialist stockbrokers which are quoted on AIM and some of these have understandably struggled through recent difficult times.

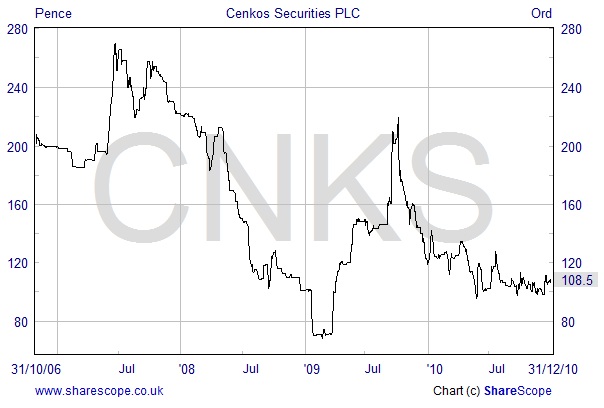

For this month’s Snippet company we have selected Cenkos, which is one stockbroker which has come through the recession rather well and must surely be well placed to benefit from improved conditions. Strangely Cenkos’s share price has yet to reflect any improvement in market conditions.

One thing that may be holding back the shares is an outstanding claim against the company for commission from another broker. On 16 December Cenkos reported that the Court of Appeal had upheld a decision against it regarding the claim for commission from a ‘sub broker’. However, Cenkos reported that it believed that its maximum liability here will be approximately £2.3 million; a sum which should not be too much of a problem for a company which reported cash in excess of £13 million at its 2010 interim results.

On a more positive note the 16 December RNS also contained good news on current trading, with the Company stating: ‘Since the announcement of the Company's interim financial statement on 30 September 2010 the Company has continued to trade strongly and will enter 2011 with a high degree of confidence.’

More Information

Cenkos lists its principal activities as: corporate finance, corporate broking, institutional equities, market making and high net-worth private client stockbroking. Further information on the Company, including recent fund raising transactions, can be found at its website - www.cenkos.com/home.aspx.

As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research. As with many brokers there are no forecasts available for Cenkos but the interim results issued in September 2010 are helpful in understanding the business and how the 2010 financial year is progressing.

fast improving position

share price has yet to reflect any improvement in market conditions

cash in excess of £13 million

Copyright © Aimzine Ltd 2011

y without prior consent. ADVFN will BAN those who post AIMZINE articles without prior permission.

| Recent Aim Snippets | |||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |