Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here |

Each month we trawl through hundreds of RNS statements from AIM companies. In this column we highlight an exceptional company announcement, particularly where we feel the market may not have taken full account of recent news.

A big risk

Investors who purchase shares in a loss making company are always taking a big risk. This is particularly the case where the company is developing new ‘wonder products’ which take years and a lot of money to prepare for market. Seasoned AIM investors will have seen many seemingly fantastic prospects fail when expectations are not realised. Often the company simply runs out of money and investors run out of patience.

However, despite the history of failure, risk investors are still keen to seek out new opportunities. The difficulty for private investors is that for most businesses they do not have the specialised market or product knowledge to properly understand the likelihood of success of a particular venture. Even analysts that do possess the specialised knowledge frequently fail to perceive all of the business risks and ‘call it wrong’.

However, despite these ‘health warnings, this month’s Snippet selection is a loss making company which is still eating up capital. We just wonder if this one is turning the corner or may at least have the ‘corner’ in sight.

Cyan Holdings

On 1 September Cyan announced that, subject to a general meeting, it proposed to raise £1.8 million (after expenses) in a placing at 0.75 pence per share. In addition the company propose to issue a £450,000 convertible loan note to an institutional investor – the loan note would be convertible at 1 pence per share.

The new placing shares will represent 28.21% of the enlarged share capital of the company, which will certainly dilute existing shareholder’s interests. Although, shareholders should not have been surprised by the news since the company did warn back in March that it needed to raise more funds.

Last year Cyan raised £3.2 million in two placings and shareholders must be wondering when the placings and further dilution will cease. However, there is hope.

may have the corner in sight

Hope Springs

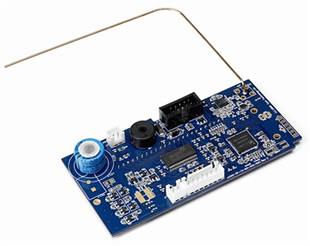

Cyan is a fabless semiconductor company providing wireless solutions for lighting control, utility metering and industrial telemetry. These markets have considerable potential for the right product and Cyan seems confident that their products can achieve significant sales. The following trading statement included in the placing announcement is worth studying:

Cyan has developed new products specifically for the Indian Electricity Metering market and for the Sodium and Xenon HID lighting markets and has several customers with these embedded into their own products which have already been submitted into multiple tenders, some of which are understood to be for 100k units. These customers are established suppliers to the utilities and all have existing run rate manufacturing capacity in excess of one million units per annum. These customers have indicated to Cyan that significant costs are incurred in each tender bid and that they expect to win at least a portion of most of the tenders for which they bid. Specifically, the Company has signed an MOU with a multinational electronics customer to integrate Cyan's products into that customer's sodium ballast and the Directors expect this to develop into a volume order during 2011.’

‘With a product range that is now well developed and which is receiving increased levels of commercial traction from its primary customers, the Directors believe that the prospects for the Company for the remainder of 2010 and beyond are promising. Given the number of prospective companies with which Cyan is actively engaged and the fact that several customers are tendering for major projects which, if successful, would result in significant orders in 2011, the Directors are excited about Cyan's prospects and view the future with confidence.’

The company’s directors have also shown their confidence in the business with all three directors purchasing shares during July. Furthermore, ‘to retain cash in the business’, two of the directors have agreed to sacrifice their income from Cyan to purchase new shares in the company – the directors in question are CEO, Kenneth Lamb, who will use half of his income to purchase shares and Non‑executive Director, John Read who will use all of his income to purchase shares.

There is obviously no certainty that Cyan will get the significant sales that they hope for and there may well be more dilutive placings to come. However, there are signs that matters may be improving and it should be worthwhile monitoring developments at this company.

As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research. We recommend the following reading as a good starting point for researching Cyan:

Aimzine contribution from Cyan’s CEO in August 2009

September 2010 ‘Proposed Placings’ RNS

markets have considerable potential

would result in significant

orders in 2011

Copyright Aimzine Ltd

y without prior consent. ADVFN will BAN those who post AIMZINE articles without prior permission.

| Recent Aim Snippets | |||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |