Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. Register here to read this month's Aimzine |

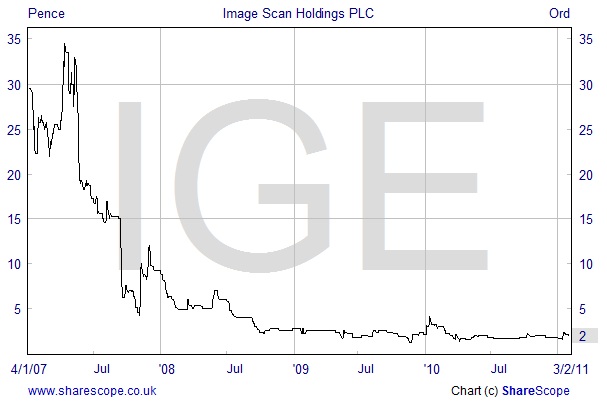

This month our Snippet company is in the ‘penny share’ league being valued at just over £1 million. Image Scan Holdings, experts in 3D X-Ray technology, first listed on AIM in 2002 at 65 pence per share. Over the years since then the Company has struggled to gain momentum as it worked to exploit the 3D imaging expertise originally developed at Nottingham Trent University. At one point in 2008 , as turnover grew and losses reduced, it did look as if Image Scan might move into profitability but its industrial sales were badly hit by the recession and losses widened once again.

Aimzine featured Image Scan in 2009 at the time that Louise George was appointed as CEO. Louise was charged with the task of bringing a commercial focus to Image Scan. Since that time we have monitored events at Image Scan to look for signs of progress and such a ‘sign’ has recently been reported by the Company. On 24 January 2011 Image Scan reported that it had won two major contracts – the largest for £750,000 with a major nuclear facility – and that its order book had grown to £1.3 million. This compares to an order book of just £95,000 reported by the Company on 8 October 2010.

Image Scan has also recently, on 24 January, issued their final results for the year to 30 September 2010. The results showed some progress and at the time Brian Emslie, Chairman of Image Scan, commented: ‘The financial results for 2010, whilst still disappointing, mask the fundamental progress being made in changing the historical culture and repositioning the strategic focus of the Company. The contracts secured since the year end are an encouraging testament to our implementation of the strategy during the past two years in developing a business based on marketing a range of standard security systems whilst pursuing high value industrial opportunities. During the year the cost base was further reduced despite the additional investment of appointing a UK sales manager. I believe that we now have the appropriate infrastructure and mix of skills capable of focusing on securing additional revenue growth and delivering expected operational and technical performance. The order intake in the year to date provides a stronger platform for the Company to move towards its key short-term goal of achieving breakeven.’

FlatScan portable X-ray system

fundamental progress

being made

Q&A with Louise George

I contacted Chief Executive, Louise George, to ask about the improving position at Image Scan. My questions and Louise’s responses (in blue) are below:

1. |

It was pleasing to note that Image Scan recently secured a large contract win with a major nuclear facility. Can you say any more about the nature of the contract e.g. which equipment is being supplied and how it will be utilised?

|

|

Given the confidentiality of our contract, there is little more to add over and above that disclosed in the RNS. We are supplying an x-ray solution for the management of nuclear waste to a contractor in that sector. The end user is a major nuclear facility in the UK.

|

2. |

Also, can you say why the customer selected Image Scan’s equipment in preference to competitive products?

|

|

The image quality and the analysis thereof was critical in the supplier selection.

|

3. |

In the ‘nuclear’ contract announcement you mention that the company will be looking for further wins in this sector. Can you say any further regarding this? Are the opportunities primarily in the UK, or are you looking abroad for further contracts?

|

|

We have about 4 other leads in the UK nuclear sector. A small contract of £70k was secured in January subsequent to this large contract. This is for the supply of x-ray equipment to a different nuclear UK installation, and we hope that it might open the door for further work on that site. It is important that we get traction and gain a reputation within our home market before raising expectations overseas, but clearly we would not rule anything out. However, at present the opportunities that we are handling are all UK-based.

|

4. |

The industrial side of your business has been very quiet over the last two years. Indeed last October you reported that Industrial work represented just 16% of sales. Do you think that the recent contract wins signal a return to strength in this division?

|

|

Our customer is experiencing increased demand, hence the investment in our equipment. As an organisation we are being far more circumspect about which industrial enquiries we pursue because x-ray is not a cheap solution, so we need to make a judgement upfront as to whether it is going to lead to a commercially viable solution with the potential for repeat sales. Too often in the past we would spend time analysing the problem, determining a solution just for this to be beyond the potential customers cost justification.

|

5. |

Over the last 4 months it would seem that your cash position is almost unchanged at just over £300,000. Are you expecting to be cash flow positive for the rest of the financial year now that you have secured new contracts?

|

|

Whilst the recent orders can give us a degree of comfort in preparing a cash flow forecast, we do not have visibility of all sales in the coming year, so it would be misleading to the market to make a prediction of positive or negative cash flow.

|

6. |

......Or are you looking to raise further capital during the year? |

|

We are not actively seeking to raise further capital at present and our cash flow forecast suggests that we have sufficient funds to see the company through the coming year.

|

7. |

In the final results statement, there was a comment that: “the Board will continue to assess potential strategic options”. Can you say anything further on this comment?

|

|

There is little to add other than our institutional investors often suggest that we should become part of something larger. As a Board we recognise that for many shareholders they are looking for either growth or an exit. Therefore, if an opportunity arises where we feel that either of these goals can be enhanced by taking a more strategic course of action then the Board would consider this very carefully.

|

8. |

It is nearly 2 years since we last spoke to you – see our March 2009 article here. At the time you had recently been appointed as CEO and you told AImZIne that you were keen to bring a “commercial focus to the business”. Can you say how the business has changed in these two years and whether you feel that you are succeeding in bringing this commercial focus to the business?

|

|

In the two years since my appointment we have moved from being a business supporting 17 staff of which there was just one dedicated salesman, to a team of 16 staff of which we have a dedicated sales team of 3 backed up by a marketing administrator. Our trading company website (www.3dx-ray.com) has been relaunched and as a result our natural search rankings have improved dramatically and all our marketing literature has been revamped. Our sales team are active in many territories across the world but particularly in the Middle East, Southeast Asia, China and India and have established a good representation throughout these regions.

We have also seen the product development move from being a domain of the technical team to being driven by market demand as expressed by end user feedback to our sales team.

We have also recruited a dedicated sales manager for the UK so as to increase our market profile within both Government and corporate organisations within our home territory. Much of the highly respected feedback as referred to above has emerged from these sources.

|

9. |

Finally, now that the 2011 financial year has begun well, can you say how confident you are that this improvement will carry through into the second have and beyond? |

|

We are seeing a number of tenders in the market place being written around our technology, so we are expecting this to lead to a higher conversion rate. Until we build up a solid base of repeat orders it would be dangerous to give a prophesy on H2. However, with the broader product range, the increased marketing profile and the larger sales team, I would be hopeful that we will see some of this recent momentum continue. |

We are most grateful to Louise George for answering these questions for AimZine.

As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research. Image Scan is a tiny company which has never recorded a profit in its 9 years on the AIM market and as such it must be in the high risk category. Nonetheless, there are some good early signs that the business could be turning an important corner and if this is the case there should be considerable scope for share price improvement.

Louise George

image quality was critical

experiencing increasing

demand

search rankings have improved dramatically

seeing a number of tenders

in the market place

Copyright © Aimzine Ltd 2011

y without prior consent. ADVFN will BAN those who post AIMZINE articles without prior permission.

| Recent Aim Snippets | |||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |